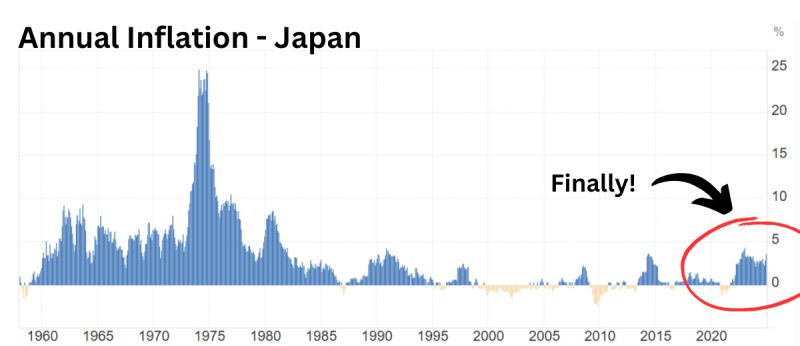

Sustained near 4% inflation in Japan is a colossal development in global financial markets no one talks about.

It allows the BoJ to continue raising rates and this has insane consequences.

🧾 Since 2012, Yen has been getting weaker against the dollar. About 50%, to be exact. That means if you held Nikkei225 which over the last 12 years rose over 300%, your return in dollars was only 150%. That scared almost all of the global investors away.

But this can change now.

By having strong inflation, BoJ can raise rates and strengthen their currency. This makes Japan stock market attractive for global investors, again.

🧾 For the last three years, in local currency, Japan’s stock market was ranked TOP1-TOP2 in performance, beating almost every other market. In 2023, it beat S&P500, just like in the last quarter of 2024. It’s already doing well. (JPM Research)

🧾 In 2024, Nikkey225 broke all-time highs after 34 years. Historically, indices tend to chase the highs for some time due to the euphoric sentiment.

It is a unique setup.

Leave a Reply