Originally posted on 2025-01

US Dollar is putting insane weight onto the entire planet. Countries will either ignore it and get wrecked or deal with it. Support for US treasuries is very close.

Nearly 90% of the planet’s FX transactions occur with a Dollar sign on it. As Dollar becomes stronger (+9% over the last 3 months), countries need to swap more of their domestic currencies to do the same transaction and this drives inflation.

🏦 FED is essentially the world’s central bank.

Rising Dollar also tends to depress global trade since most of the purchasing power is denominated in the greenbacks, so when it rises- countries need to produce more resources, goods and services, to buy the same thing. It simply makes the planet poorer.

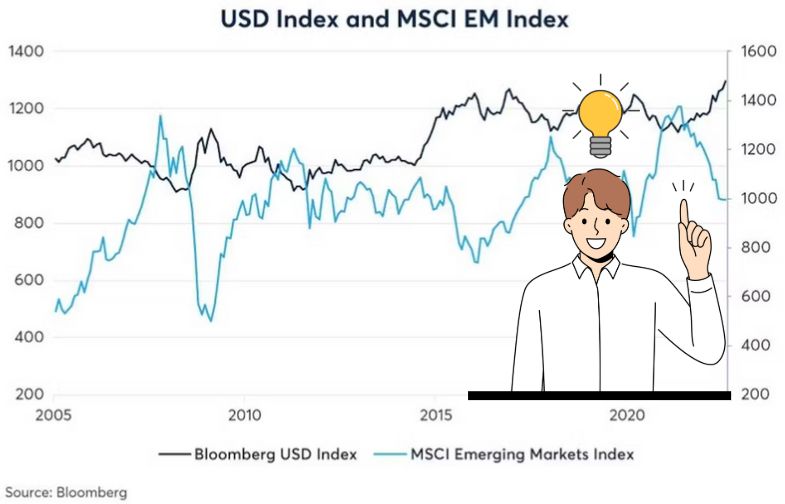

Emerging Market (EM) yields usually rise, too, as they are often denominated in US Dollars- investors flock to safer assets. It makes those countries less credit-worthy.

No wonder EM stocks tend to move in reverse to US Dollar. So the main question arises- how is the world going to deal with it?

💵 Hedge- buy US Treasuries.

And what absolute masterclass in timing did FED or the universe engineer. When US institutions are dumping long-term treasuries, since FED is allowing inflation to run, governments from abroad may start stepping in to become the big buyers. Support is likely very close. 6% yields? Would not bet on it.

US Debt is exploding, but so is the Dollar. What a combination.

Trump should aim to keep the Dollar high. US will get to refinance easier at the expense of the planet.

Leave a Reply