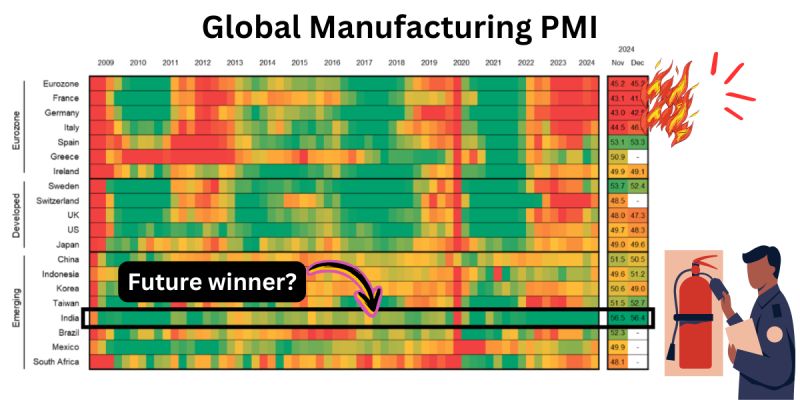

Do you notice two major trends in the chart below? These are shaping our world.

1️⃣Europe is incredibly cyclical and at the bottom. However, first signs of recovery are here.

Current crisis, which lasts for almost 2 years, can also be seen in the stock market. EU stocks are dragging US by historical margins. With that said, the average duration of “in the red” is also around 2 years, looking at the chart below. I see that as a potential signal that the recovery may be around the corner. (Not saying past represents the future)

-> we’re also starting to see slightly better figures for Italy, UK, Spain, Sweden. This is a good thing.

2️⃣ India is always green with no stopping in sight. In the coming Trump term which will target China, Europe and neighboring Canada, Mexico -> India is in a position of being one of the few countries which Trump is yet to take a big shot at.

It also has 1.4B people and a massive, 8% GDP growth rate.

We will probably see a lot more companies move production into India. At some point it will become a big trend and bring outsized returns to their stock market. When? I have no answer, but Trump 2.0 could be a trigger.

💡 For now, it could be that European manufacturing stock prices are somewhere close to the bottom and we may see a rebound in 2025.

Do you think Europe has the potential to come out of this sea of reds?

Chart source: JP Morgan AM

Leave a Reply