Originally posted on 2025-01

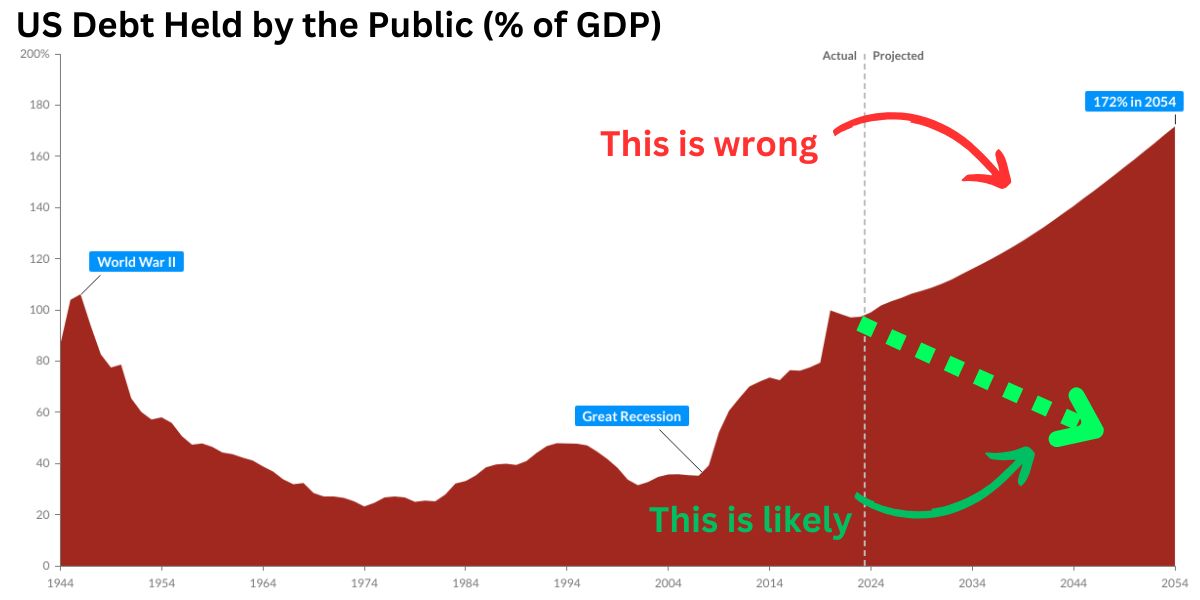

There are reasons to believe that debt grinding has begun. It can shape the markets for the next 10-30 years as it did from the late 1940s all the way to 1980s.

All the current projections show US going towards extreme debt-to-GDP ratios or in other words, moving in the same trajectory as it has since the 1980s. But even FED is confirming that this is wrong.

US is spending >1T USD annually in interest payments. This is unsustainable and everyone knows it. To get rid of this burden, country can either default (not an option) or grind it away through higher inflation.

So what is FED doing right now?

Engineering higher inflation for longer. There is a reason why long-term yields are rising in a cutting cycle. FED is starting the next super trend where bonds, real estate and cash are the ultimate losers. They have to be, if they want to combat national debt.

Similarities with post-war era.

📰 Average inflation in 1948 to 1980 was 4% with the first 7% spike in 1948 and a subsequent 8% spike in 1951.

📰 Yields on short-term bonds were only 0.375% all the way to 1947. After the 7% inflation spike yields started to rise, slowly, to allow the inflation to run, but not too much. By the end of 1970s Debt-to-GDP has fallen to less than 30% and we got another 2 waves of inflation. Yields rose to 15% and that marked the end of an era.

It is very likely the same approach is being taken right now. It is no surprise FED started easing even though inflation’s at 3%. It can’t and it won’t hit that 2% sweet-spot. Too low for Debt progress.

So how did US markets do (from 1948 to 1980) ?

Dow Jones Index rose 440%. (CAGR 5.4%)

Bonds underperformed.

We had 6 market crashes, increase in volatility.

Real estate? -forget about refinancing.

Leave a Reply