Originally published on 2025-01

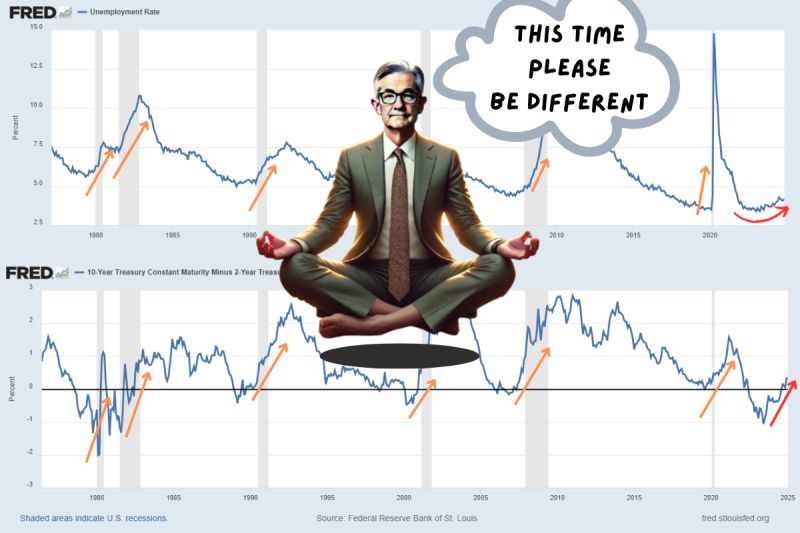

FED is in trouble? If past tells us anything about the future- recession is literally around the corner. But the market will give it a try making this time different.

First of all, every single time:

– 10Y – 2Y sharply reverses up,

– Unemployment starts rising,

– Inflation sharply goes down after a spike,

– Median Sales Price of Houses Sold goes flat/down,

– Temporary workers employment goes down…

…US gets a recession. And every single one of these indicators is giving a monstrous negative signal.

However, everyone keeps arguing that this time is different. They do have valid points. For example: Government is printing nuclear amounts of money and it settles like this: FED -> Banks -> Bonds -> Stocks, causing financial inflation. What also helps is that there is no alternative other than US.

🌍 Europe is cooked in regulation.

🌍 China is boiling in the consequences of non-free market.

🌍 Everyone is still scared of Japan.

So the US market is holding on to the outside flows and QE by the FED, that means? Not exactly. There is also technology.

Analysts from Bespoke Investment Group were calculating, that if we removed every AI hype stock, today SPX would be around 20% lower. Almost 0 gains this year.

There has to be something that will hold the market next year. Google’s Willow chip is a good start. But the technology is still pretty far away from commercial use. A possible China-US carry trade could also emerge, although it’s a difficult topic politically. AI? Old story. Space exploration? Would need Spacex to go full IPO. There has to be a growth story. And it has to be big.

When you see one, go all in. Otherwise, it’s not looking great.

Leave a Reply