I want to start working out. Will do it from Monday! A meeting with some sales guy? Man, push it to the next week, I’m done with this one.

It seems obvious, that humans tend to plan and do things according to time. Since the old times, we would go to sleep when the sun sets and wake up at the sound of a rooster. Midday? Too hot, will make some tasks at home and head to feed the animals in the evening. Nowadays, an apple watch with a clock as precise as some atom making exactly 9192631770 vibrations every second. We are addicted to time. We plan and do everything according to it. We’re so into it, that we won’t start doing things if it’s not a multiple of 5! Have you ever seen anyone drop you a calendar invite at 15:37?

This personal behavior of ours leads us, humanity, towards predictable patterns as a whole. This article is going to be the first of, possibly, many articles digging into our dependency of time, and how to find the edge in it.

For the dataset to test for, I will be using Yahoo SPY daily prices from 1993 to 2023 September. The first analysis is going to focus on simple Open/High/Low/Close/Volume analysis by the weekday. The goal is to see if any of the days sets apart due to some underlying reason. Software that is going to be used is google sheets.

During my time trading I have noticed that Mondays are the days of undecidability (not sure if that’s a real word). Why? If everyone starts everything on Monday, then you would guess that it will be quite messy- ranging market. Volumes should be big, too? What about Friday? Should never change the trend? But these are just guesses.

Let’s start looking into the data and formulate a few metrics by what we are going to measure the behavior.

Volatility: This can be taken with a formula of =ABS(1-(High/Low) prices and we get a percentage value of how much during the day the market moved.

Trend: A simple =ABS(1-(Open/Close)) formula will tell us how much the market moved during the day and closed.

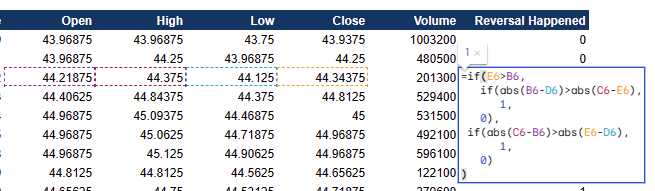

Reversal: We will determine that a reversal has happened with a slightly more complicated formula. If day was green, then we look for lower wick to be longer than upper wick. See formula in Fig. 1. We are essentially trying to find green candle with big wick down or a red candle with big wick up.

As a first step, we calculate the standard deviation of the volatility and then put it into the intervals every 0.2. An easy way to put them all into the intervals is this formula: =ROUND(Volatility*5,0)/5.

With =SUMIFS we can the make a distribution chart for every weekday, additionally we can calculate skewness and mean. See table in Fig. 2

Notice that the more skewed (more positive number) to the right the distribution is, the less volatility on average this day will have. Monday stands out as the one who is the least skewed to the left. Additionally, the mean is the smallest and surprisingly for me, volumes are the smallest too! That explains the smaller volatility. Notice, that Wednesday-Thursday are the most volatile ones. That gives a clue of when to expect the reversals or big moves to happen. With the exact process, we get a table for trend metric, shown in Fig. 3

Conclusion

Thursdays are the most volatile, yet trending days. When trading Thursday, it’s best to use small stops and try to catch the big fish! Breakouts could work. Mondays are the most skewed to the right, meaning they are the least trending days.

With this very simplified example I am demonstrating that some parts of our psychology can be seen and felt in the markets. Get me no wrong, the margins are very small. However with the clues on hand we can investigate further and have some meat for the backtests.

Trade range on Monday, catch a reversal on Wednesday, go for a big day on Thursday.

Leave a Reply