♦️ This is a winning strategy where numbers are no longer essential. It’s because in the modern ages, Alpha is generated by following the narrative.

You see, the human brain can actively hold only 4 to 7 pieces of information at a time.

But there are thousands of data points we can find with a single click on economy or the favorite stock.

⚡ This is why “The human brain has always been highly tuned towards narratives, whether factual or not, to justify ongoing actions, even such basic actions as spending and investing” – R. Shiller — It’s because we can’t deal with so much data at a time.

By simplifying everything we’ve become so attracted to the single yet a powerful idea, that this became the behavior of the entire market.

A single idea.

Here’s just a couple of examples:

Trump tariffs bad – entire market crashes 📉

Trump tariffs good – entire market recovers 📈

Quantum is good – quantum stocks rush higher 📈

Quantum will be in 10 years – quantum stocks sell off 📉

DeepSeek will destroy US AI industry – entire market sells off 📉

DeepSeek actually is good for US AI industry! – market recovers 📈

Data, at least in the short-medium term becomes trivial.

All it takes to create a powerful trend is a well published story.

Then it spreads like a wildfire- a mind virus that flies across the population influencing our decisions, propelling the market.

—

So can a strategy be made that exploits the power of narratives?

A paper released by State Street, an asset manager with over $4 trillion of AUM, “Quantifying Narratives and their Impact on Financial Markets” tested just that.

One of the key findings were:

“Narrative-conscious strategies can improve asset allocation”

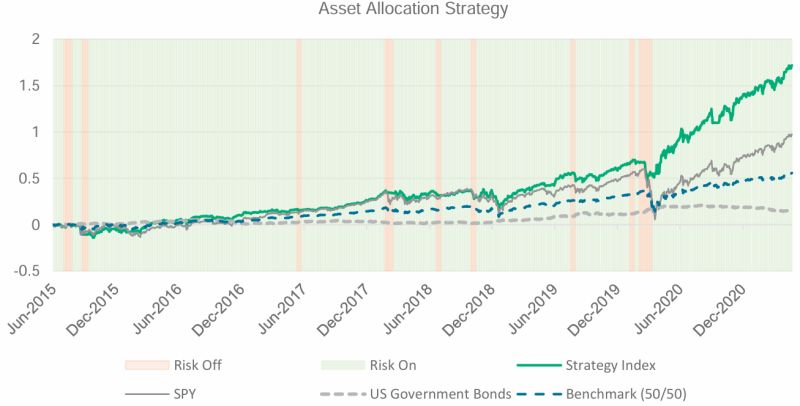

So they looked into a prevailing narrative and made demo investment decisions. It showed an increase in performance and even a decrease in risk! (chart below)

One thing for sure.

Importance of stories has never been higher.

The big question becomes:

How do we differentiate between a noise-narrative and the real trend-setter?

Leave a Reply