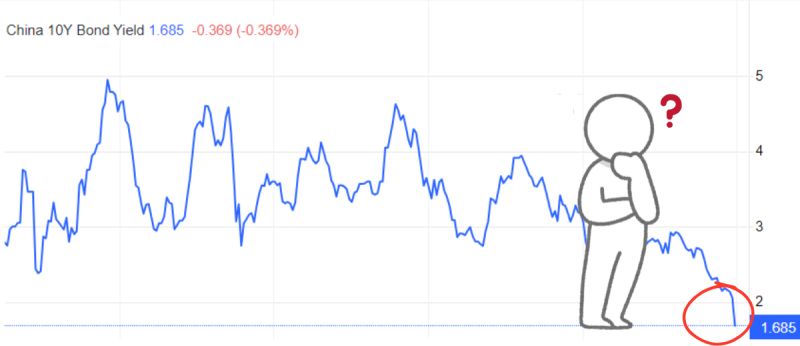

Chinese 10Y yield is now below 1.7%. The implications of this is absolutely bazookas and may lead to insane US performance, similar to what happened with Japan in the early 1990s.

The 1.7% long term rates imply flight to safety and deflationary pressures. At the same time Yuan is depreciating making sure not a single outside buyer is interested. The only buyer left is their central bank.

Even with steroidal domestic monetary policy, easing’s here and there, inflation is unable to pop back up as their asset bubbles were popped a couple years prior. This is exactly what Japan experienced:

🧾 In 1989, tightening in monetary policies popped their asset bubbles and their economy plunged into recession one year later. Excess savings skyrocketed, current account surplus surged to over 3.5% GDP and western countries responded with a strong Yen policy. Soon, the Japanese banks, some of the largest in the world, were close to failing. Could not let that happen.

🧾 Meanwhile FED had engineered the steepest yield curve in decades, allowing banks to borrow short term for cheap and lend out long-term, pocketing up to 5%. This allowed US banks to repair their sheets. To save Japanese banks, one G7 meeting later, it was agreed that Yen will be kept low and Japanese banks will be able to borrow in Yen & lend to US, without fear of currency loss.

Coming back to today:

China excess savings are 28% of the planet, current account surplus just rose to almost 3.5%. Asset bubbles were popped, country is facing deflation even under stimulus. Chinese banks, some of the largest banks on the planet, are facing huge problems. The threat of global deflation is looming.

The only way to solve this for China may as well be to import inflation by buying US papers. Borrow in Yuan (1%), buy USD (4.5%). Last piece of the puzzle- we need guarantees that Yuan will remain low, to mitigate currency risk. A new massive carry trade.

Dec 11 (Reuters) – China’s top leaders and policymakers are considering allowing the yuan to weaken in 2025

Largest savings on the planet (>3 Trillion USD) are on the brink to move.

Leave a Reply